While a high annual fee credit card might seem counterintuitive, perks like generous rewards, travel credits, and premium benefits can easily offset the cost for frequent travelers or big spenders. It's crucial to assess your spending habits and travel patterns. Compare referrerAdCreative offerings, focusing on rewards programs, bonus categories, and travel insurance to determine if the value outweighs the annual fee, ensuring the card aligns with your lifestyle for maximum return.

Understanding the Value Proposition: Beyond the Annual Fee

The primary reason a high-annual-fee card can be worthwhile lies in the richer rewards, perks, and privileges they offer. Think of it like this: you're paying for access to a premium experience. These benefits are designed to enhance your spending habits and lifestyle in ways that can more than compensate for the fee.

Here's a breakdown of some common areas where these cards excel:

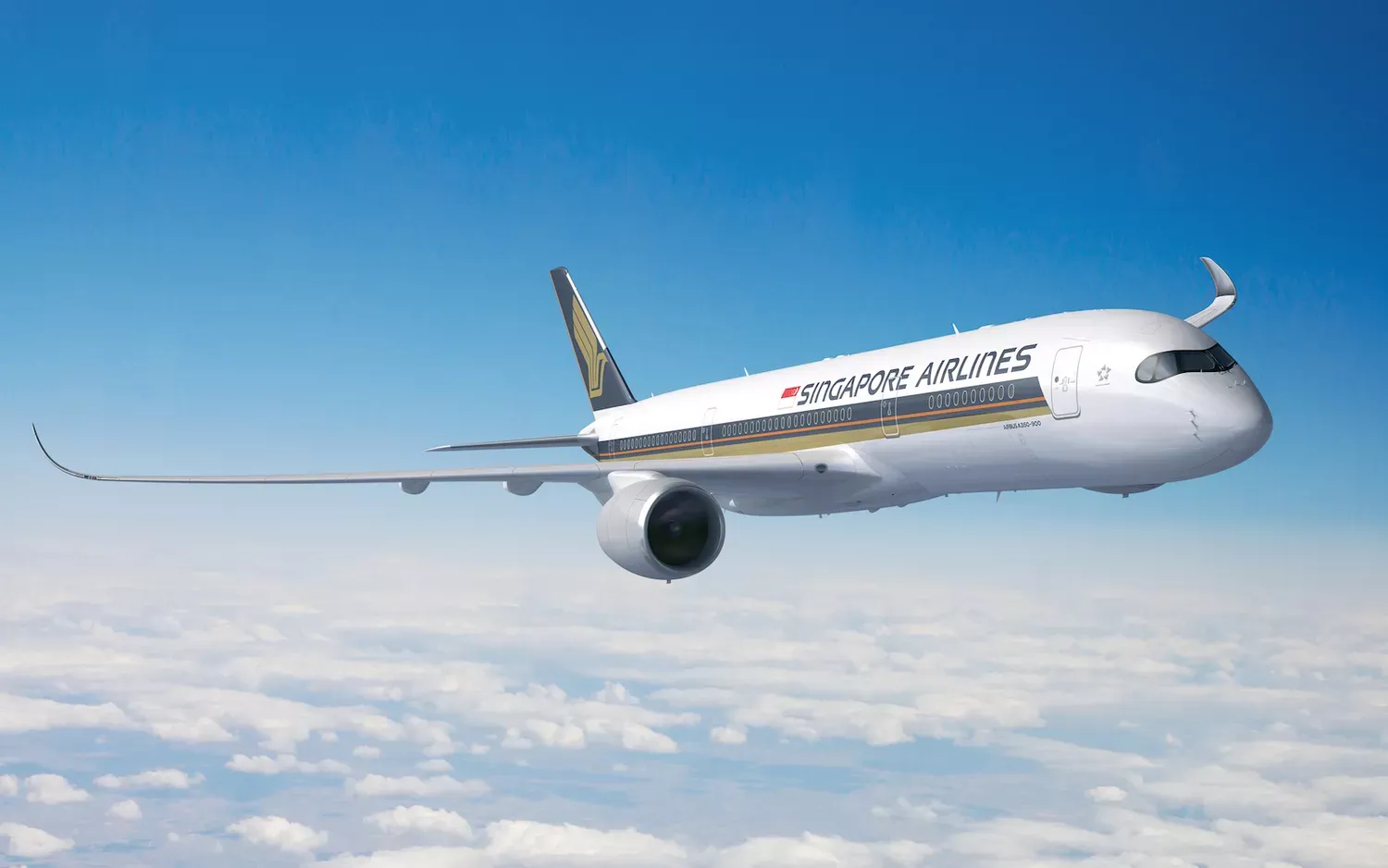

Travel Rewards: Many high-end cards offer significantly higher points or miles earning rates on travel purchases. They might also provide statement credits for travel-related expenses, access to airport lounges, complimentary hotel upgrades, and travel insurance benefits.

Cash Back Rewards: While many no-annual-fee cards offer cash back, premium cards often provide elevated rates on specific spending categories (like dining, groceries, or gas) or a flat rate that’s higher than what you'd typically find elsewhere.

Statement Credits: Many cards offer annual statement credits that can be used towards specific purchases, such as travel, dining, or even subscriptions. These credits effectively reduce the net annual fee.

Luxury Perks: Concierge services, purchase protection, extended warranties, return protection, and cellphone protection are common perks that can provide significant value, especially if you frequently make expensive purchases or travel often.

Elite Status: Some cards offer automatic elite status with hotel chains or airlines. This status can unlock benefits like room upgrades, priority boarding, and free breakfast.

Calculating the Break-Even Point: Is It Worth It for You?

Before applying for a card with a high annual fee, it's crucial to do the math. Calculate how much you would need to spend in specific categories to earn enough rewards or utilize enough benefits to offset the annual fee. This is often referred to as the "break-even point."

Consider the following example. You are looking for a card that will allow you to gain a substantial amount of travel rewards that would compensate for travel purchases and elevate your travel experience.

Let's say a credit card has a $550 annual fee and offers 5x points on travel purchases and 2x points on dining. You value each point at $0.01. To break even, you'd need to earn $550 worth of rewards. That means:

Travel spending needed: $550 / (5 points x $0.01) = $11,000

Dining spending needed: $550 / (2 points x $0.01) = $27,500

If you spend significantly less than $11,000 on travel or $27,500 on dining annually, this card might not be the best choice for you. However, if you regularly spend more than those amounts, the rewards could easily outweigh the annual fee.

Comparing Cards: What to Look For

Once you've determined that a high-annual-fee card could be a good fit, the next step is to compare your options. Here's a table highlighting some key considerations:

Feature |

Description |

What to Consider |

|---|

Annual Fee |

The yearly cost to own the card. |

Can you realistically offset this with rewards and benefits? Are there credits that can reduce the effective fee? |

Rewards Structure |

How you earn points, miles, or cash back. |

Does the card offer bonus categories that align with your spending habits? What's the value of the points or miles? Are there redemption limitations? |

Statement Credits |

Credits applied to your statement for specific purchases. |

Are the eligible purchase categories things you normally spend money on? What are the spending requirements? |

Travel Benefits |

Airport lounge access, travel insurance, hotel upgrades, etc. |

How often do you travel? Will you actually use these benefits? Are there limitations or restrictions? |

Luxury Perks |

Concierge service, purchase protection, extended warranty, etc. |

Will you utilize these perks? Do the terms and conditions of these protections fit your needs? |

Factors Beyond the Numbers: Consider Your Lifestyle

Ultimately, the best credit card is the one that best fits your individual needs and spending habits. Don't just focus on the numbers. Consider how the card's benefits will impact your overall lifestyle. For example, if you value convenience and personalized service, the concierge service offered by some premium cards could be a major draw, even if it's hard to quantify the monetary value.

Also, remember to factor in responsible credit card usage. Paying your balance in full each month is crucial to avoid interest charges, which can quickly negate any rewards you earn. A high-annual-fee card is only worthwhile if you're using it responsibly and maximizing its benefits.

Making the Decision: Is a $500 Card Right for You?

A $500-a-year credit card isn't for everyone. But if you're a frequent traveler, a big spender in specific categories, or someone who values luxury perks and services, it could be a smart investment. By carefully evaluating your spending habits, comparing your options, and calculating the break-even point, you can determine whether a premium credit card is the right choice for your financial situation and make the most of your credit card.